Introduction to Forex Activa

Forex Activa, a term coined from “foreign exchange” and “activa,” represents the active involvement of traders in the forex market. It encompasses various strategies, techniques, and tools utilized by traders to engage in currency trading actively. Understanding Forex Activa is crucial for anyone looking to navigate the dynamic world of forex trading effectively.

Definition and Overview

Forex Activa refers to the proactive approach taken by traders to actively participate in the forex market. Unlike passive investment strategies, where investors hold positions for extended periods, Forex Activa involves frequent buying and selling of currency pairs to capitalize on short-term price movements.

Historical Background

The concept of Forex Activa has evolved alongside advancements in technology and the globalization of financial markets. With the advent of electronic trading platforms and the internet, individual traders gained unprecedented access to the forex market, leading to the rise of active trading strategies.

Importance in the Forex Market

Forex Activa plays a significant role in providing liquidity and efficiency to the forex market. Active traders contribute to price discovery and market efficiency by reacting quickly to news, economic data releases, and other market events. Additionally, their trading activity helps to narrow bid-ask spreads and reduce transaction costs for all participants.

Understanding Forex Activa Trading

Basics of Forex Activa

Forex Activa involves the execution of short-term trading strategies, aiming to profit from intraday price fluctuations. Traders analyze various factors, including economic indicators, geopolitical events, and technical chart patterns, to identify trading opportunities.

Types of Forex Activa

There are several types of Forex Activa strategies employed by traders, including scalping, day trading, swing trading, and position trading. Each approach has its unique characteristics, risk profile, and time horizon, catering to different trader preferences and market conditions.

Market Analysis and Research

Fundamental Analysis

Fundamental analysis involves evaluating the underlying factors that influence currency valuations, such as economic indicators, central bank policies, and geopolitical developments. Traders use this information to assess the intrinsic value of currencies and make informed trading decisions.

Technical Analysis

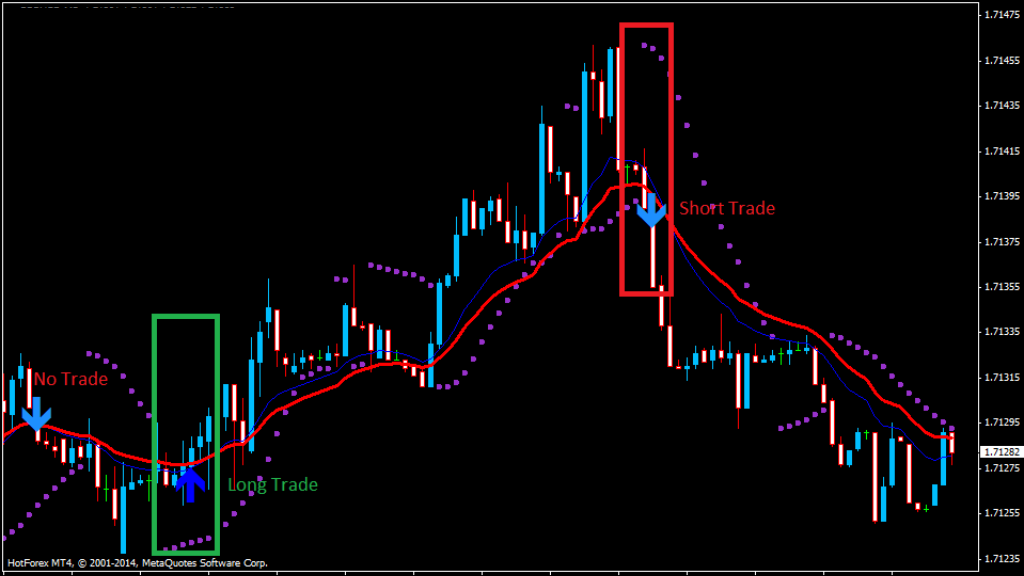

Technical analysis focuses on studying historical price patterns and market data to forecast future price movements. Traders utilize various technical indicators, chart patterns, and statistical tools to identify trends, support and resistance levels, and potential entry and exit points.

Risk Management

Stop Loss and Take Profit

Stop loss and take profit orders are essential risk management tools used by traders to limit potential losses and lock in profits. A stop loss order automatically closes a position at a predetermined price level to prevent further losses, while a take profit order does the same to secure gains.

Position Sizing

Position sizing involves determining the appropriate amount of capital to allocate to each trade based on risk tolerance and account size. By controlling the size of their positions relative to account equity and stop loss levels, traders can manage risk effectively and avoid excessive losses.

Risk-to-Reward Ratio

The risk-to-reward ratio measures the potential profit relative to the potential loss for each trade. By aiming for trades with a favorable risk-to-reward ratio, such as 1:2 or higher, traders seek to maximize their profitability while minimizing their exposure to losses.

Getting Started with Forex Activa

Choosing a Broker

Selecting a reputable and reliable forex broker is crucial for successful Forex Activa trading. Traders should consider factors such as regulation, trading platforms offered, customer support, and transaction costs when choosing a broker.

Account Types

Forex brokers typically offer various types of trading accounts to cater to different trader needs and preferences. Common account types include standard accounts, mini and micro accounts, and Islamic accounts, each with its specific features and benefits.

Opening an Account

The process of opening a forex trading account involves registering with a broker, completing account verification procedures, and depositing funds into the trading account. Traders must adhere to the broker’s requirements and provide accurate information during the account opening process.

Forex Activa Trading Strategies

Scalping

Scalping is a short-term trading strategy that involves executing multiple trades throughout the day to capture small price movements. Scalpers aim to profit from rapid price changes and often hold positions for only a few minutes or seconds.

Day Trading

Day trading involves buying and selling financial instruments within the same trading day, with all positions closed before the market closes. Day traders capitalize on intraday price fluctuations and typically avoid holding positions overnight to avoid overnight risks.

Swing Trading

Swing trading is a medium-term trading strategy that aims to capture price swings or “swings” in the market over several days to weeks. Swing traders identify trends and trade in the direction of the trend, holding positions for more extended periods than day traders but shorter than position traders.

Position Trading

Position trading is a long-term trading strategy that involves holding positions for extended periods, ranging from weeks to months or even years. Position traders base their decisions on fundamental analysis and macroeconomic factors, seeking to capitalize on long-term trends in the market.

Advanced Forex Activa Techniques

Algorithmic Trading

Algorithmic trading, also known as algo trading or automated trading, involves using computer algorithms to execute trades automatically based on predefined criteria. Algorithmic traders develop and backtest trading strategies to automate trade execution and capitalize on market inefficiencies.

High-Frequency Trading

High-frequency trading (HFT) is a form of algorithmic trading that utilizes sophisticated algorithms and high-speed data connections to execute a large number of trades within milliseconds. HFT firms leverage technology to exploit small price discrepancies and arbitrage opportunities in the market.

Options Trading

Options trading involves buying and selling options contracts, which give the holder the right, but not the obligation, to buy or sell a financial instrument at a predetermined price on or before a specified date. Options traders use various strategies, such as calls, puts, spreads, and straddles, to profit from price movements and volatility in the market.

Forex Activa Psychology

Trader Mindset

The trader mindset refers to the psychological attitude and mindset adopted by traders when approaching the market. Successful traders exhibit traits such as discipline, patience, emotional control, and adaptability, enabling them to navigate the challenges of forex trading effectively.

Trading Psychology Tips

To cultivate a successful trading psychology, traders must develop emotional resilience and discipline. They should focus on maintaining a positive attitude, managing stress effectively, and learning from both wins and losses to improve their trading performance over time.

Forex Activa Regulations and Compliance

Regulatory Bodies

Forex trading is regulated by various regulatory bodies worldwide, including government agencies, financial authorities, and self-regulatory organizations. These regulatory bodies oversee the forex market, enforce rules and regulations, and ensure fair and transparent trading practices.

Compliance Requirements

Forex brokers and traders are subject to compliance requirements aimed at safeguarding investor interests and maintaining market integrity. Compliance measures include anti-money laundering (AML) regulations, know your customer (KYC) procedures, and adherence to best execution practices.

Risks and Challenges in Forex Activa Trading

Market Volatility

Market volatility refers to the degree of variation in price movements of financial instruments over time. While volatility presents opportunities for profit, it also poses risks, as prices can fluctuate rapidly and unpredictably, leading to potential losses for traders.

Leverage and Margin

Leverage allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and losses. While leverage can enhance returns, it also increases risk, as traders may incur significant losses if the market moves against their positions.

Counterparty Risk

Counterparty risk refers to the risk of default or non-performance by a trading counterparty, such as a broker or financial institution. Traders should assess the creditworthiness and reliability of their counterparties to mitigate the risk of financial loss due to counterparty default.

Future Trends in Forex Activa

Technological Advancements

Advancements in technology, such as artificial intelligence (AI) and machine learning, are transforming the forex market landscape. AI-powered trading algorithms and predictive analytics tools enable traders to gain insights from vast amounts of data and make more informed trading decisions.

Global Economic Trends

Global economic trends, including geopolitical events, monetary policy changes, and economic indicators, significantly impact currency markets. Traders must stay informed about global economic developments and adapt their trading strategies accordingly to capitalize on emerging opportunities and mitigate risks.

Conclusion

In conclusion, Forex Activa encompasses a wide range of trading strategies, techniques, and tools employed by active traders to navigate the dynamic forex market successfully. By understanding the fundamentals of Forex Activa, adopting effective trading strategies, managing risks prudently, and staying abreast of market trends, traders can enhance their trading performance and achieve their financial goals in the forex market.

FAQs:

1. What is Forex Activa?

Forex Activa, derived from “foreign exchange” and “activa,” refers to the active involvement of traders in the forex market, employing strategies to capitalize on short-term price movements.

2. What are the different types of Forex Activa strategies?

Forex Activa strategies include scalping, day trading, swing trading, and position trading, each catering to different time horizons and risk profiles of traders.

3. How important is risk management in Forex Activa trading?

Risk management is paramount in Forex Activa trading to mitigate potential losses and protect capital. Techniques such as stop loss orders, position sizing, and risk-to-reward ratios are essential for managing risk effectively.

4. What are some common challenges in Forex Activa trading?

Common challenges in Forex Activa trading include market volatility, leverage and margin risks, counterparty risk, and psychological factors such as emotional control and discipline.

5. How can traders stay informed about future trends in Forex Activa?

Traders can stay informed about future trends in Forex Activa by monitoring global economic trends, technological advancements, and regulatory developments, and adapting their trading strategies accordingly to capitalize on emerging opportunities.